colorado estate tax form

Form 104PN - Nonresident Income Tax Return. Their telephone number is 303 343-1268.

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

DS 056S - Personal Property Short Form DS 058 - Renewable Energy Property DS 060 - Lessor Personal Property DS 155 - Residential Personal Property DS 618 - Coal Real and Personal Property DS 628 - Producing Mines Real and Personal Property DS 648 - Earth or Stone Products Real and Personal Property DS 654 - Oil and Gas Pipelines.

. If you are a personal representative or executor you should make sure your accountant knows how to prepare an estate income tax returns Form 1041. Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein. Application for an Affidavit Emissions Extension.

Note however that the estate tax is only applied when assets exceed a given threshold. The estate tax is a tax applied on the transfer of a deceased persons assets. Form 104PN - Nonresident Income Tax Return.

DR 1079 - Payment of Withholding Tax on Certain Colorado Real Property Interest Transfers. Real Property Transfer Declaration TD-1000 Real Property Transfer Declaration Completion Guide TD-1000 Government Assisted Housing Questionnaire. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone.

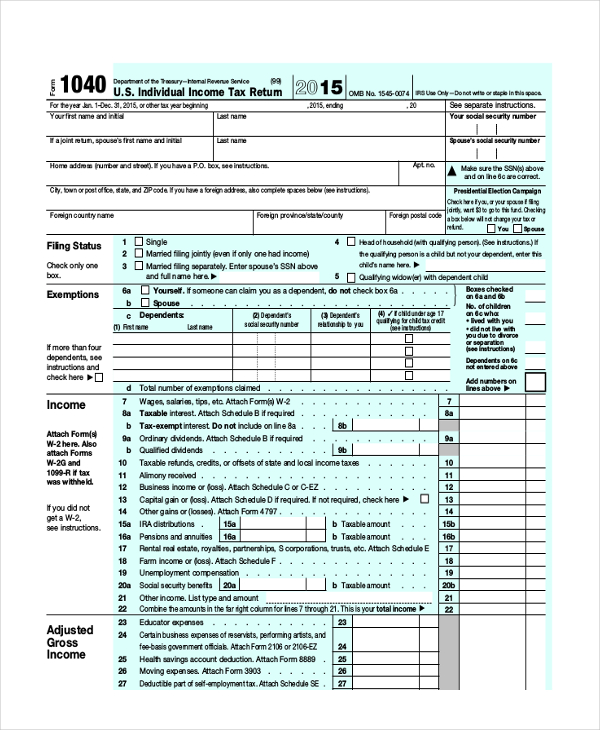

DR 0104TN - Colorado Earned Income Tax Credit for ITIN Filers. For 2021 this amount is 117 million or 234 million for married couples. Instructions for Form 1040 Form W-9.

2021 Extension Payment for Colorado Individual Income Tax. Request for Taxpayer Identification Number TIN and Certification. DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest.

Forms can also be obtained from their web site at wwwdmvastatecousviewpagephpUGFnZUIEPTU. The estate tax is a tax applied on the transfer of a deceased persons assets. In addition victims of severe storms flooding and.

DR 0105 - Colorado Fiduciary Income Tax Return form only DR 0158-F - EstateTrust Extension of Time for Filing DR 0253 - Income Tax Closing Agreement DR 0900F - Fiduciary Income Payment Form DR 1210 - Colorado Estate Tax Return DR 8453F - Fiduciary Income Tax Declaration for Electronic Filing 2022 Estimated Payment Forms. DR 0105EP - EstateTrust Estimated Tax Payment Form DR 0104BEP - Colorado Nonresident Beneficiary Estimated Income Tax Payment Form DR 0366 - Rural Frontier Health Care Preceptor Income Tax Credit Form Helpful Forms DR 0002 - Colorado Direct Pay Permit Application DR 0096 - Request for Tax Status Letter. DR 0104CR - Individual Income Tax Credit Schedule.

We will update this page with a new version of the form for 2022 as soon as it is made available by the Colorado government. What Is the Estate Tax. 2022 Colorado Estimated Income Tax Payment Form.

2021 Colorado Amended Income Tax Return Form and Instructions. DR 0104US - Consumer Use Tax Reporting Schedule. Under current law no Colorado estate tax filing is required for estates of individuals who die after December 31 2004.

Affidavit of Non-residence and Military Exemption from Specific Ownership Tax. If the date of death occurs prior to December 31 2004 Form DR 1210 must be filed. Statutes Probate Codes Article 12 Part 12 Collection of Personal Property by Affidavit How to File 4 steps Step 1 Wait Ten Days Step 2 Ensure Eligibility Step 3 Fill out Form JDF 999 Step 4 Distribute Assets Step 1 Wait Ten Days.

Colorado Estate Tax. Application forms are available from the Colorado Department of Military and Veterans Affairs Division of Veterans Affairs 7465 E. The estate tax is levied on an estate after a person has died but before the money is passed on to their heirs.

Beneficiaries commonly receive taxable income from estates. 2021 Consumer Use Tax Reporting Schedule. Claim for Refund on.

Colorado Part-YearNonresident Tax Calculation Schedule 2021. DR 5714 - Request for Copy of Tax Returns. DR 1830 - Material Advisor Disclosure Statement for Colorado Listed Transaction.

Only a small percent of Form 1040 preparers are capable of preparing estate income tax returns. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. 2022 to file their 2021 returns and pay any tax due as do victims of Colorado wildfires and straight-line winds that began Dec.

May increase with cost of living adjustments. In other words when an estate is passed on the federal government taxes the transfer. There is no estate tax in Colorado.

Other Colorado Estate Tax Forms. Individual Tax Return Form 1040 Instructions. Application for Low-Power Scooter Registration.

Estimated tax payments are due on a. It is one of 38 states with no estate tax. Hotel or Motel Mixed Use Questionnaire.

Application for Change of Vehicle Information IRP DR 2413. DR 1778 - E-Filer Attachment Form. Nonresidents of Colorado who need to file income taxes in the state need to file Form 104PN.

Form 104EP - Estimated Individual Income Tax Return. DR 0104EE - Colorado Easy Enrollment Information Form. The Colorado Judicial Branch recommends obtaining multiple notarized copies of the affidavit.

Estate income tax is a tax on income like interest and dividends. DR 0104EP - Individual Estimated Income Tax Payment Form. It is sometimes referred to as the death tax The estate tax is different from the inheritance tax.

Colorado has no estate tax for decedents whose date of death is on or after January 1 2005. DR 0104PN - Part-Year ResidentNonresident Tax Calculation Schedule. Affidavit of Non-Commercial Vehicle.

Additional information on filing can be found on the Colorado Department of. 1st Avenue Suite C Denver CO 80230.

We Make You A Fake Tax Return Document For 2017 Or Earlier Year Great Proof Of Annual Income For Application Purp Tax Return Income Tax Return Irs Tax Forms

Paper Tax Forms Vanishing Leaving Some In A Bind The Denver Post

Filing A Schedule C For An Llc H R Block

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Tax Prep Checklist

Estate Income Tax Return When Is It Due

How To File Taxes For Free In 2022 Money

Printable Tax Prep Checklist On White Background With A Calculator Pencils And 1040 Form Tax Prep Checklist Tax Prep Tax Checklist

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Accounting Small Business Bookkeeping Small Business Tax

Fillable Form W4 2013 Edit Sign Download In Pdf Pdfrun Tax Forms Income Tax Payroll Taxes

Pdf Simple Tax Preparation Checklist Tax Prep Checklist Tax Prep Tax Preparation

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Understanding The 1065 Form Scalefactor

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition